Table Of Content

These programs, which usually offer assistance with down payment grants, can also help with closing costs. The U.S. Department of Housing and Urban Development lists first-time homebuyer programs by state. Select your state, then “Homeownership Assistance,” to find the program nearest you. There are a number of government programs available to prospective homebuyers who are struggling to come up with a down payment.

Forgivable Loans (At 0% Interest)

Applicants usually still need to have decent credit and documented income. It is important to remember that a down payment only makes up one upfront payment during a home purchase, even though it is often the most substantial. There are also many other costs that may be involved, such as upfront points of the loan, insurance, lender's title insurance, inspection fee, appraisal fee, and a survey fee. A very rough estimate for the amount needed to cover closing costs is 3% of the purchase price, which is set as the default for the calculator. With a larger down payment, you won’t have to borrow as much mortgage to complete the purchase of your home.

Current Mortgage Rates by State

However, this still represents $32,950 for a down payment on an average home—a hefty amount for most people. Add in closing costs, moving expenses and needed home maintenance and the total becomes even more daunting. That’s just the cutoff many lenders use for requiring private mortgage insurance (PMI) on a conventional loan. If you put less than 20% down, leave some wiggle room in your budget to account for the cost of monthly mortgage insurance payments. You generally need to put 20% down to avoid paying private mortgage insurance (PMI) on a conventional loan. PMI istypically a monthly fee that gets added to your monthly mortgage payment or is paid upfront by the lender in exchange for a slightly higher interest rate.

Sample loan programs

VA loans and USDA loans can have a zero-down payment, but you must meet the minimum qualifications set by both programs. You won’t get a zero-down conventional loan, but you can get a zero-down government-backed loan. Homes that only need a few minor repairs can be a bargain for new buyers.

Most down payment assistance programs are locally based, with many operated by governmental agencies and area-specific organizations. Since each program is different, there are no universal DPA requirements. Some lenders may be willing to offer you lender credits – funds that can be used for your closing costs – in exchange for charging a slightly higher interest rate on your mortgage.

How can I apply for down payment assistance?

The remaining balance you would need to finance with a home loan is $270,000. With a 30-year fixed-rate mortgage at 7% interest, your monthly mortgage payment would be about $1,796 – excluding taxes or insurance costs. A down payment on a house is the money a buyer pays upfront to complete the real estate transaction. Down payments are typically a percentage of a home’s purchase price and can range from 3% – 20% for a primary residence.

The less money you borrow, the more money you save on interest over the life of the loan. The down payment you need will partly depend on the type of loan you choose. Another minimum down payment factor to account for is whether you’re buying a primary residence, secondary residence or investment property.

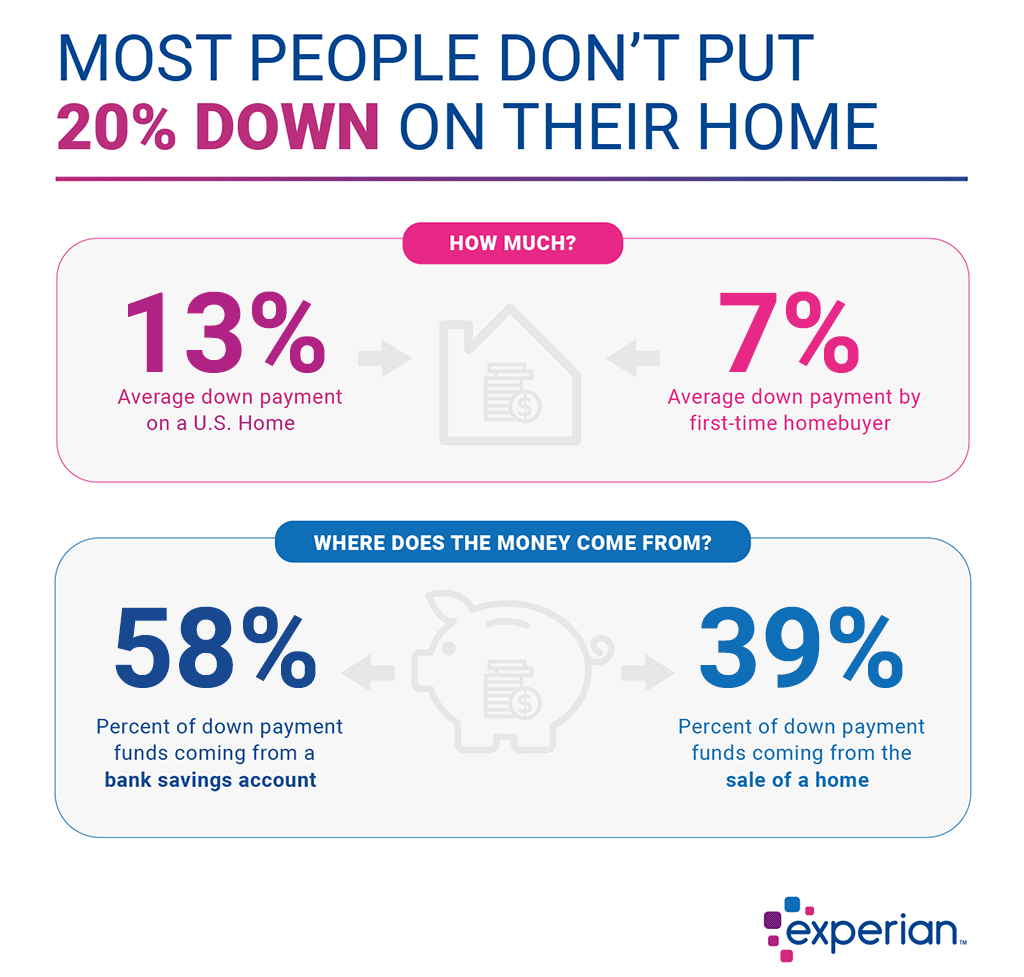

If you’re required to make a down payment, you might put down between 3 percent and 20 percent of the home’s purchase price, depending on your savings and what type of mortgage you’re getting. Redfin reports that the median home sales price in the United States is $411,887. The 20% down payment rule is now a thing of the past; the average first-time homebuyer puts down about 8% of the home’s purchase price.

Tennessee First-Time Home Buyer 2024 Programs and Grants - The Mortgage Reports

Tennessee First-Time Home Buyer 2024 Programs and Grants.

Posted: Tue, 23 Apr 2024 07:00:00 GMT [source]

Places with the highest median down payments (in dollars)

Her creative talents shine through her contributions to the popular video series "Home Lore" and "The Red Desk," which were nominated for the prestigious Shorty Awards. In her spare time, Miranda enjoys traveling, actively engages in the entrepreneurial community, and savors a perfectly brewed cup of coffee. And you may even be able to buy a home with no money down if you qualify for a VA or a USDA loan. You’ll need to put 20% down to avoid paying private mortgage insurance (PMI) on a conventional mortgage loan.

Immediately deposit any money you earn from side hustles into your savings account to prevent accidental spending. Having a side hustle relieves the pressure of cutting back on an already tight budget and speeds up your savings timeline. You need to know how to save money for a house to reach your goal as quickly as you can. The ways to build your home savings aren’t complicated, but they take some mindfulness, dedication and consistency. Her favorite topics are investing, mortgages, real estate, budgeting and entrepreneurship.

'Buying a first home is harder when you're single' - AOL

'Buying a first home is harder when you're single'.

Posted: Sun, 28 Apr 2024 12:44:56 GMT [source]

She holds a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan. If you’re ready to finance your home buying dreams, apply with Rocket Mortgage® now. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful.

The size of your down payment depends on your savings, income, and budget for a new home. The amount you designate as a down payment helps a lender determine the loan amount for which you qualify and the type of mortgage that meets your needs. Paying too little upfront will cost you interest over time while putting down too much could deplete your savings or negatively affect your long-term financial health. Ideally buyers would be able to put down at least 20% of the home price to avoid paying private mortgage insurance, but it’s not a requirement.

As a type of government-backed mortgage, interest rates are typically low for USDA loans. Mortgage insurance is technically not required, but you do have to pay an upfront “guarantee fee” of 1% and an annual fee of 0.35% of your total loan. The US Department of Agriculture offers USDA loans to promote homeownership in rural areas for low and moderate-income buyers. Income limits vary by region and the number of occupants in your home, but you’ll generally need to make no more than 115% of your area’s median income – about $110,000 per year in most areas.

The 20% down payment recommendation can make homeownership feel unrealistic – but the good news is that very few lenders require 20% at closing. That said, making a down payment that equals 20% of a home’s purchase price offers advantages. An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. Some mortgages require a large down payment, but if you plan to use government-backed financing like an FHA loan, you may qualify for a lower down payment.

No comments:

Post a Comment